Sen. Rep. Bill Cassidy, R-La., discusses the Republican plan to save Social Security and Varney & Co. to Bernie Sanders' 32-hour work week idea.

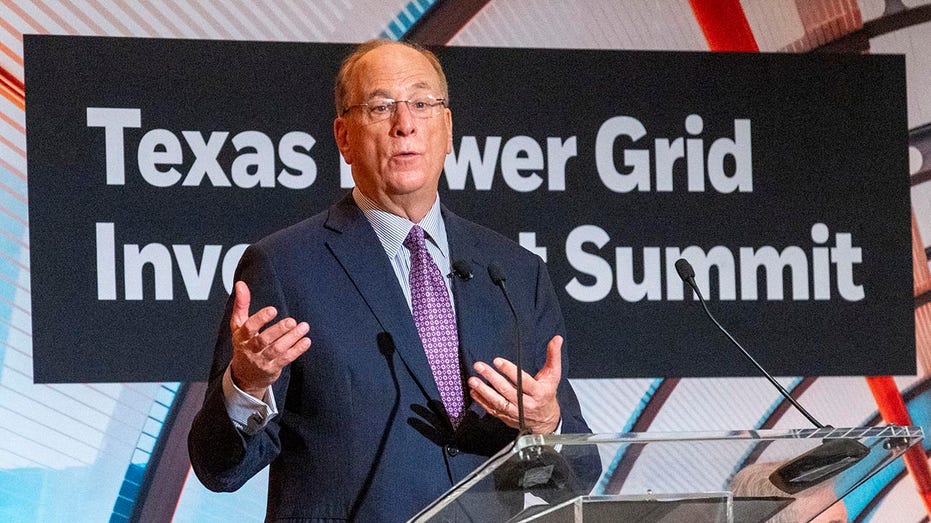

BlackRock CEO Larry Fink In his annual letter to investors on Tuesday, he cited the “enormous pressure” on Social Security due to the aging of the U.S. population and the need to reform the pension system as it faces bankruptcy.

Fink explained the economics behind it Social securityIt collects taxes from working people to pay retirees who receive benefits: “The government takes a portion of your income during your working years and sends you a check every month after you retire. The idea actually. It originated in pre-World War I Germany, and this 'Old age insurance' schemes gradually became more popular in the 20th century.

“Think of a 65-year-old man in 1952, when I was born, and if he hadn't already retired, that person was ready to stop working. But now think of that person's former colleagues, everyone around him. The 1910s was the age at which he entered the workforce. In 1952, most of them The data show that there was No Getting ready to retire Because they are already dead.” Fink wrote.

The Social Security Trust is on the verge of insolvency

BlackRock CEO Larry Fink said Social Security's retirement age is “a little crazy” because the plan is insolvent and benefits will be cut over a decade. (Victor J. Blue/Bloomberg via Getty Images/Getty Images)

Data from the Social Security Administration (SSA) show that as of 1955, the ratio of workers paying taxes to the number of beneficiaries was 8.6 workers. That number dropped to 2.8 in 2013 due to the aging of the U.S. population.

Fink noted that Americans' longer life expectancy in retirement also worsens Social Security's financial health, saying, “Today, if you're married and both you and your spouse are over 65, there's a 50/50 chance that at least one of you will receive a Social Security check until you're 90.”

| ticker | Security | Past | change | conversion % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 820.21 | +3.86 | +0.47% |

“All of this is putting the U.S. pension system under tremendous pressure,” Fink added. “The Social Security Administration itself says that by 2034, people won't be able to pay their full benefits. What's the solution? No one should have to work longer than they want to. But I think that's a little crazy. Our anchor idea of a proper retirement age — age 65 — dates back to the Ottoman Empire. formed.”

Social Security Cuts Could Be Coming Soon – Here's Who Will Be Affected

Social Security's two main trust funds are projected to run out after another decade. (Kevin Deitch/Getty Images/Getty Images)

Social Security's two main trust funds help boost payroll taxes as a source of funding to pay benefits to beneficiaries, but they are expected to run out after another decade. Once trust funds are exhausted, incoming payroll taxes will be the only source of funding for benefits, and under current law, automatic cuts will begin to match benefits to incoming recipients.

An analysis by the nonpartisan Committee for a Responsible Federal Budget last year found that the average dual-income couple retiring in 2033 could see a 23%, or $17,400, reduction in annual benefits in current dollars — while single-income couple benefits would be cut. By $13,100.

Social Security, Medicare are on the rocks — and no leader in either party wants to move forward

BlackRock CEO Larry Fink said the asset manager will announce partnerships and initiatives to facilitate the conversation about social security and retirement in America. (Kirk Sides/Houston Chronicle via Getty Images/Getty Images)

Fink's letter says the Netherlands has moved to address the financial challenges affecting its state pension a decade ago by gradually raising the retirement age and automatically linking it to changes in life expectancy.

He suggested that America should have a conversation about what the average retirement age should be and ways to encourage people to work longer rather than retire to increase the labor force participation rate.

Get Fox Business by clicking here